2 Common Misconceptions About Agent Commissions (Even By Themselves)

We did a comparison with a few variations and tabulated the commissions we would have earned based on the schedule provided by our company.

All examples shown are based on recommending a $250,000 Whole Life Plan (With a $50,000 Basic Sum Assured times 5 until 70). If your financial planner has done a good job in helping you understanding your shortfalls, then they would find a solution that meets this and your budget.

However, many financial planners are trained to get a budget first, and then recommend a solution which fits into their budget. The issue with this is that, (i) your shortfall may not be met and (ii) the solution may not be the most efficient for you.

Figures highlighted in yellow pay the highest amount of commissions, while red pays the lowest. You would notice that both Companies A and B do not pay a higher commission just because the premium term is longer. In fact, the 20-year payment term has the lowest commission in most profiles / coverage types.

While Companies C and D seem to agree with the “longer is better” theory, our team almost never recommends them despite higher commissions, unless the client has pre-existing conditions and they are offered more favourable terms.

Premiums aside, companies A and B also offer better benefits and cash value when it comes into planning considerations for our clients.

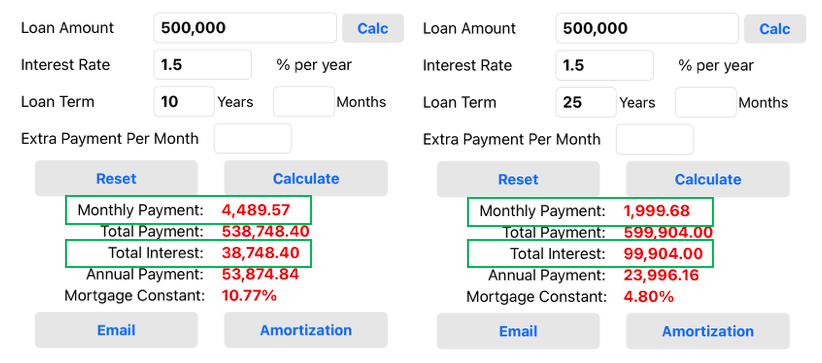

Now drawing a parallel to mortgage repayments. Assuming a loan of $500,000 is taken with an interest rate of 1.5% p.a.

Most people would naturally take the tenure that is longer despite the fact that they are paying more interest (more than 2.5x in this comparison) to the bank. Reason being cashflow management.

While you could pay less in total with a shorter term, you would have to substantially sacrifice your lifestyle, which doesn’t make much sense. That’s what we do for you when it comes to financial planning, to help you manage your cashflow without compromising too much on your lifestyle.

And in the event of an unforeseen circumstance, all your future premiums would most likely be waived and you may end up paying lesser in total.

Does recommending a Whole Life policy give us more commissions?

While this is true to a certain extent, context must be given so that we understand the full picture. Whole Life plans typically have a higher premium, which means that given the same commission rate, we would receive a higher quantum. High premiums = Higher commissions.

In our post where we discuss the topic on whether the term or whole life policy is better, we have seen several cases where it is more beneficial to our clients in the longer-term even if the whole life policy is more expensive.

For example, while the whole life policy has a higher premiums, the premium term is shorter and thus lower commissions paid out. Also, the break-even point required would be 12.5%, which would not be beneficial in the longer-term.

Thus, our role is finding the most effective solutions for our clients, and not which pays the highest commissions.

It Is Also About How We Get You There…

On the other hand, when it comes to wealth accumulation such as planning for your children’s tertiary education or retirement planning it is advisable to save and invest for as long as possible.

After all the more you save, the more you have. In this case, the agent’s commission would be in alignment with your goals… Or are they?

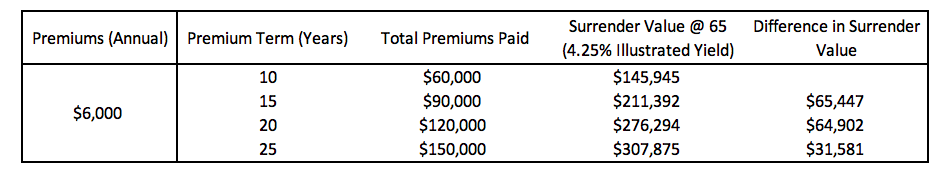

Imagine Jane, who is a 30 year-old female, wants to purchase a perpetual endowment policy (one which either matures at age 100 or 120). She wants to retire at 65, and thinks she may surrender the plan to fund her retirement.

In this scenario, it makes more sense for her to take up the 20-year premium term as the 25-year premium term plan requires her to set out an additional outlay of $30,000 while only giving her an additional $1,581 only. That would only give you a rate of return of 0.396% p.a. and you would be better off investing your money elsewhere.

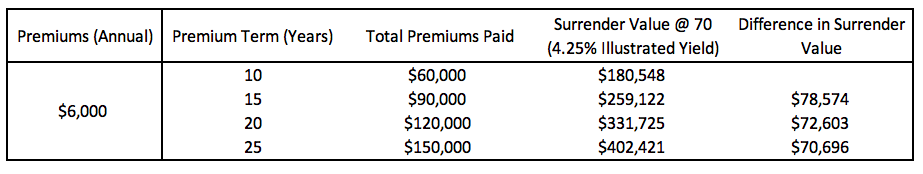

However, if she decides that she wants to retire and surrender the policy at 70 instead, then the 25-year premium term policy may make more sense. She would have gotten an additional $40,696 from the 5 extra years she committed (4.86% p.a).

Thus when it comes to wealth accumulation, longer payment terms are DEFINITELY better for agents and not necessarily for the policy owner. That is why it is important to conduct a proper financial planning session with a trusted individual to ensure that your money is put to good use.

Wealth accumulation plans are the preferred recommendations, especially by the banks and at roadshows as they require minimal to no servicing, and there is no medical underwriting required – Therefore, cases get incepted faster i.e more cashflow, no hassle.

While we do not deny that we prefer high commissions, we do not do so at your disadvantage. We show you the available options, explain which makes more sense and then implement them with you.

We invite you to reach out for a session to run through the numbers together, to ensure that our interests are aligned.