Whole Life Insurance vs Term Insurance: Which is Better?

To understand in detail, read further!

In 2018, a guideline was issued by MAS under the Financial Advisory Industry Review (FAIR) for all insurers to include a “bundled product disclosure” in the Policy Illustrations. This document highlights the differences between purchasing a whole life insurance vs term insurance.

As you will notice, despite the comparisons being done with good intentions. The coverage for term insurance is not consistent. Some insurers may choose to compare it with a cover till 70, while others till 99.

The more ideal comparison would be against a term that covers one till age 70 (or rather, how long they need cover for), as it is during our prime working years at which we require more insurance. Although there are instances where one would purchase a term till 99, it is more with the intent of Legacy Planning rather than income protection, which falls under a different topic.

With that, I have set a fe

w parameters/assumptions when it comes to comparing life insurance vs term insurance for the purpose of this post.

- Whole Life plans would utilise a basic sum assured of $50,000 with a multiplier factor of 5, giving one an effective coverage of $250,000 until the multiplier ends. This is one of the more common options given by most insurers out there.

- The other reason that this figure is chosen is due to the maximum payout any one insurer would payout in the event an Early Critical Illness (ECI) is diagnosed. Most insurers would have that limit set at either $250,000 or $350,000, which is why the former option is chosen.

- Multiplier coverage will end at 70. Again, this is the most common option that is offered by most insurance companies. Other choices range from the multiplier cover ending at 65,75,80 and even 85.

- A person is willing to stretch their payment term i.e. a premium term of 25 years and “pay till 65” will be the 2 alternatives chosen since a term cover requires commitment throughout the period of intended coverage.

- When the premium term ends for the Whole Life policy, the funds will be invested at a return of 3% p.a.

- The WL plan is assumed to be surrendered at age 70, and the surrender value taken will be th

at of the higher projected returns (4.25% p.a.)

- Price is the main focus of comparison. Hence, the cheapest option available was picked. While some of the Whole Life insurance may offer additional features, we will not highlight them.

- Any “time-limited” discounts are omitted.

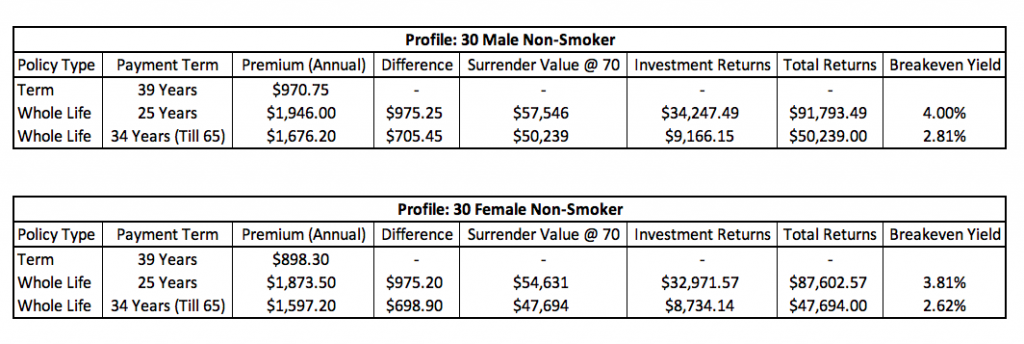

Scenario 1: $250,000 Whole Life with Advanced CI.

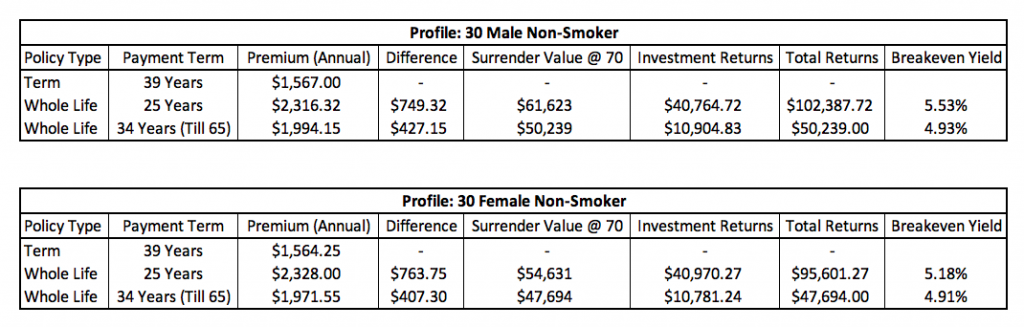

Scenario 2: $250,000 Whole Life with $125,000 Early and $125,000 Advanced CI.

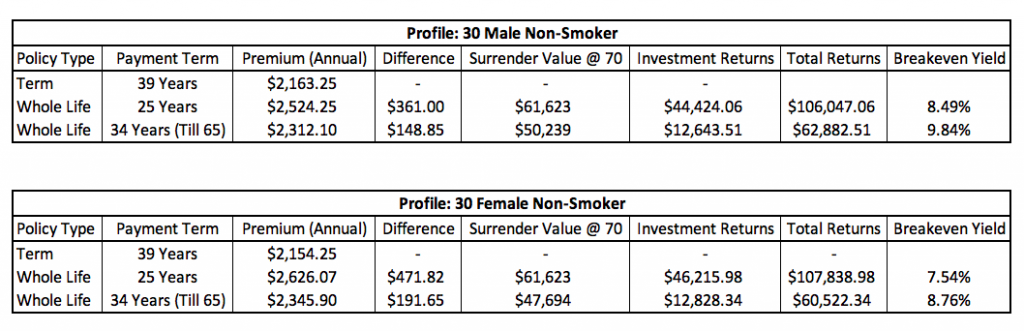

Scenario 3: $250,000 Whole Life with Early CI.

As it can be observed, the more ECI coverage we require, there is a likelihood that a Whole Life may make more sense in the “Term Insurance vs Life Insurance” debate for the given profiles.

The large-cap index will deliver a 6% average annualized return over the next 10 years, with a range of 2% to 11% possible, Goldman Sachs analysts led by Chief U.S. Equity Strategist David Kostin wrote in a July 14 note.

Also, it was noted that.

The large-cap index will deliver a 6% average annualized return over the next 10 years, with a range of 2% to 11% possible, Goldman Sachs analysts led by Chief U.S. Equity Strategist David Kostin wrote in a July 14 note.

While the break-even yields may be achievable, there is a level of investment experience and time spent required. However, one would also need to be able to pick the winners, which may make this task more challenging.

On the other hand, the returns of the whole life policy are entirely managed by the insurer’s investment team and become guaranteed once the bonuses are declared on a yearly bonus.

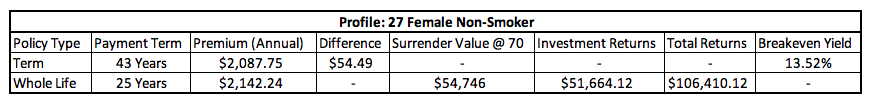

I have seen several comparisons done where the premium difference between a term insurance or whole life is almost negligible, while the premium commitment for the term insurance is longer that the risk-reward payoff would not make the most sense.

For example in this case, with a premium difference of $54.49 per year. A break-even yield needed would be 13.52% which means makes this a lot more challen

ging to achieve.

Also, achieving a yearly return of 3% once premiums are fully paid up is easier and requires a lot less risk. In fact, a bond fund may be sufficient with minimal monitoring.

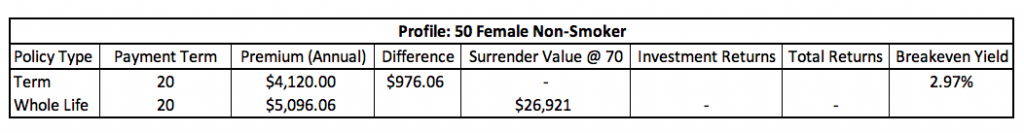

$250,000 Whole Life with ECI vs Term Insurance

When we look at the figures for a 50-year-old female non-smoker, the difference in premium can be invested to get better returns. However, we would also have to consider her risk tolerance (risk-averse vs risk-taking), and the time horizon till her intended retirement.

Key takeaway: There isn’t a better product type per se as there are several variables to consider. From the above case scenarios, it would depend very much on the profile of the client, and what are their shortfall/needs required.

If a consumer has a limited budget, a term policy may make more sense to meet his immediate needs. However, due to constraints, they may not set aside money for investments (which could lead to other long-term challenges if left untouched).

On the other hand, if one has more budget and would like to have coverage for early stages critical illnesses, it might be more financially savvy to steer towards a whole life policy.

Is there really a better solution when it comes to the perpetual debate on whole life insurance vs term?

My answer? It depends.