"4 𝘮𝘪𝘴𝘤𝘰𝘯𝘤𝘦𝘱𝘵𝘪𝘰𝘯𝘴 𝘵𝘩𝘦 𝘺𝘰𝘶𝘯𝘨 𝘩𝘢𝘷𝘦 𝘰𝘯 𝘊𝘗𝘍" is the worst ST article?

Today’s article “4 𝘮𝘪𝘴𝘤𝘰𝘯𝘤𝘦𝘱𝘵𝘪𝘰𝘯𝘴 𝘵𝘩𝘦 𝘺𝘰𝘶𝘯𝘨 𝘩𝘢𝘷𝘦 𝘰𝘯 𝘊𝘗𝘍” on Straits Times by Tan Ooi Boon has got to be one of the worst I’ve ever read.

In fact, it is clear that the editor has not done any prior research before getting this published. *Hooray to editorial standards*

In his article he mentioned 2 things that are totally wrong.

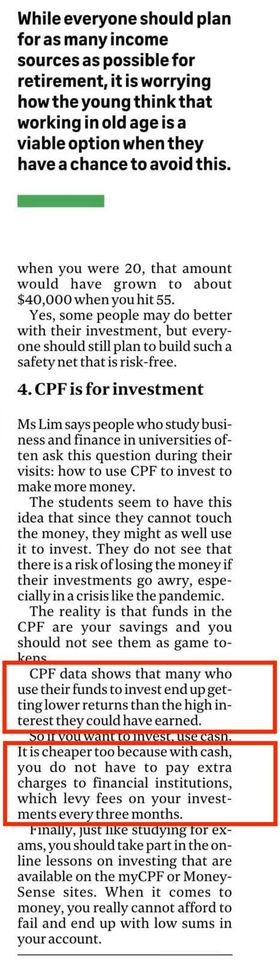

1. 𝘾𝙋𝙁 𝙙𝙖𝙩𝙖 𝙨𝙝𝙤𝙬𝙨 𝙩𝙝𝙖𝙩 𝙢𝙖𝙣𝙮 𝙬𝙝𝙤 𝙪𝙨𝙚 𝙩𝙝𝙚𝙞𝙧 𝙛𝙪𝙣𝙙𝙨 𝙩𝙤 𝙞𝙣𝙫𝙚𝙨𝙩 𝙚𝙣𝙙 𝙪𝙥 𝙜𝙚𝙩𝙩𝙞𝙣𝙜 𝙡𝙤𝙬𝙚𝙧 𝙧𝙚𝙩𝙪𝙧𝙣𝙨 𝙩𝙝𝙖𝙣 𝙩𝙝𝙚 𝙝𝙞𝙜𝙝 𝙞𝙣𝙩𝙚𝙧𝙚𝙨𝙩 𝙧𝙖𝙩𝙚 𝙩𝙝𝙚𝙮 𝙘𝙤𝙪𝙡𝙙 𝙝𝙖𝙫𝙚 𝙚𝙖𝙧𝙣𝙚𝙙.

First thing that we should all note. Investments are meant for the long-term. It only makes sense if the horizon is longer i.e 10 years or more ideally.

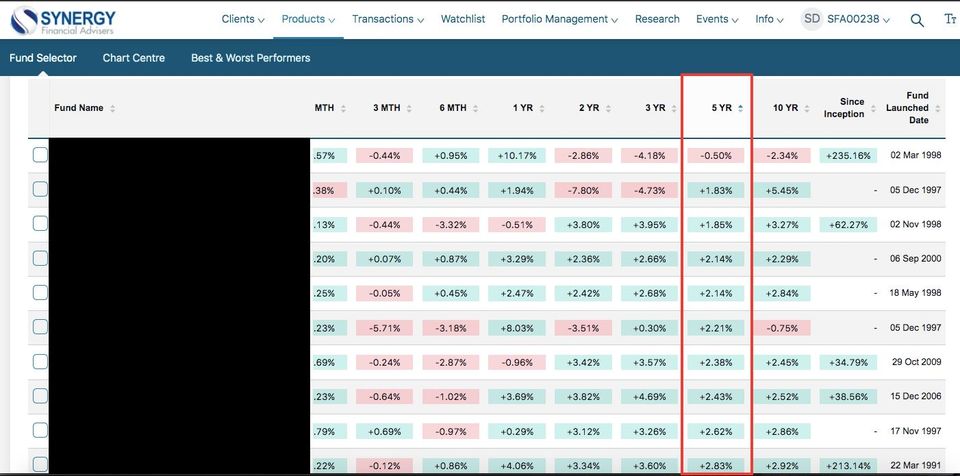

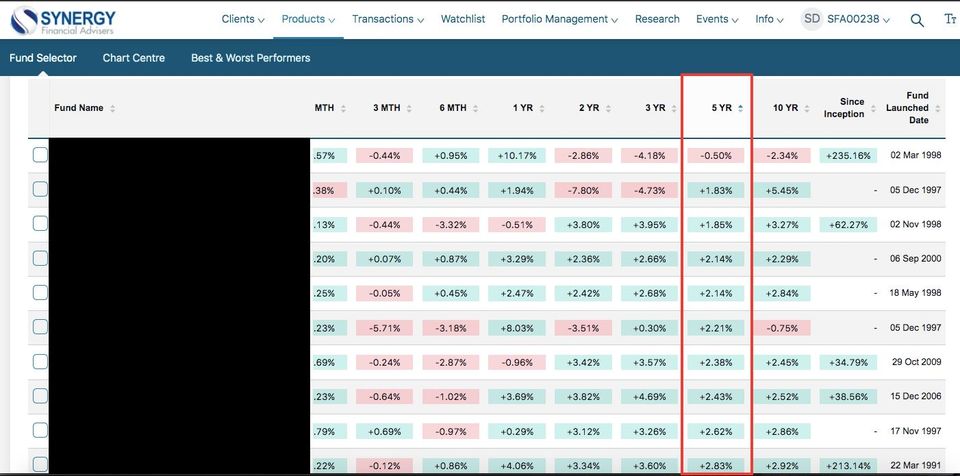

One of the platforms where I manage my clients’ investments with has access to 74 funds under the CPFIS scheme. Specifically the OA account.

Of which, if you see the screenshots (of which I have arranged in ascending order). Looking at the 5-year annualised returns, only 8 funds underperformed the CPF-OA interest rate of 2.5%. Which means if you had invested your CPF-OA money, you would have had an 89% chance of beating the guaranteed interest.

Now, if we look at the 10-year annualised returns instead – only 4 funds underperformed the CPF-OA this time around. Which means, you would have had a 94.6% chance of beating the CPF-OA rates.

2. 𝙄𝙩 𝙞𝙨 𝙘𝙝𝙚𝙖𝙥𝙚𝙧 𝙩𝙤𝙤 𝙗𝙚𝙘𝙖𝙪𝙨𝙚 𝙬𝙞𝙩𝙝 𝙘𝙖𝙨𝙝 𝙮𝙤𝙪 𝙙𝙤 𝙣𝙤𝙩 𝙝𝙖𝙫𝙚 𝙩𝙤 𝙥𝙖𝙮 𝙚𝙭𝙩𝙧𝙖 𝙘𝙝𝙖𝙧𝙜𝙚𝙨 𝙩𝙤 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙞𝙣𝙨𝙩𝙞𝙩𝙪𝙩𝙞𝙤𝙣𝙨 (𝙁𝙄𝙨), 𝙬𝙝𝙞𝙘𝙝 𝙡𝙚𝙫𝙮 𝙛𝙚𝙚𝙨 𝙤𝙣 𝙮𝙤𝙪𝙧 𝙞𝙣𝙫𝙚𝙨𝙩𝙢𝙚𝙣𝙩𝙨 𝙚𝙫𝙚𝙧𝙮 𝙩𝙝𝙧𝙚𝙚 𝙢𝙤𝙣𝙩𝙝𝙨.

Again, this is pure fiction and totally untrue. This same platform I use charges a platform fee of up to 0.28% p.a. for CASH investments, while they do not charge anything for CPF investments.

In addition, financial representatives typically charge a sales charge of up to 4% for new monies received in cash, and an annual fee of up to 2% p.a..

While on the other hand, representatives/FIs are NOT allowed to impose an upfront sales charge (i.e. 0%), with an annual fee of ONLY 0.4% compared to cash.

This came into full effect as of October 2020.

How is then possible for monies invested in cash to have incurred lower charges?

The editor has a lot of homework to do if he wishes to make un-substantiated claims.

***Disclaimer: However, do note that this is NOT financial advice and future returns are not guaranteed and may end up lower than the CPF-OA rates. Only upon a financial needs analysis can proper advice be provided to see what best fits your risk profile and needs.