Should I Invest Using CPF? Here’s Why You Should.

When it comes to retirement planning, one of the tools that I use to help my client is to invest using CPF. This is after factoring any mortgage repayments and contributions that goes into their accounts.

- How much and what can I invest with my CPF money?

- How to invest CPF monies?

- Should I invest using CPF?

- Other Considerations

How much and What can I Invest with?

According to the CPF website, one is able to participate in the CPF Investment Scheme (CPFIS) as long as they are above 18 years of age, not an undischarged bankrupt. You are only allowed to invest any amount in excess of $20,000 in your Ordinary Account (OA), or in excess of $40,000 in your Special Account (SA).

In addition, up to 35% of the investible amount can be in stocks, while 10% can be in gold. More information on what products you use can be found on CPF’s website here.

How to invest CPF monies?

- You can open an account with an investment platform such as iFast or POEMS, and link your CPFIS to it.

- Now you can start investing!

Should I Invest Using CPF?

For this discussion, we will focus on Unit Trusts (UTs). Investment-linked insurance products (ILPs) are also factored in as their underlying instrument are UTs, The only difference is they can only be distributed through insurance companies.

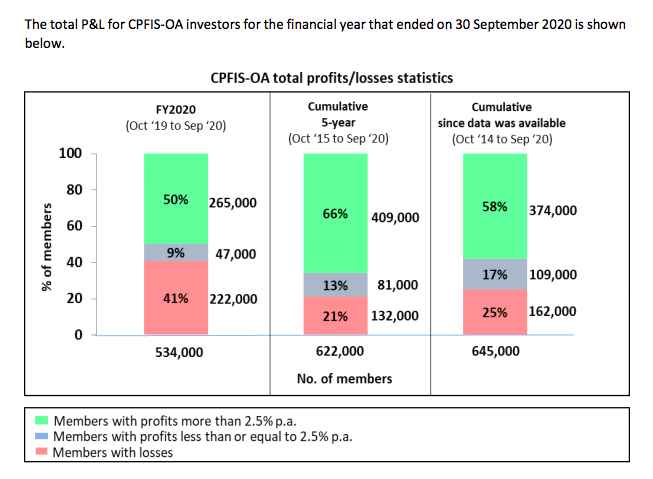

Profit and Losses for CPFIS-OA Investors for the period ending 30 September 2020

While only about 50% of members made a higher return in the 1-year period from October 2019 to September 2020, investments are meant for the long-term.

The time-frame shown is too short and may have been affected by certain uncontrollable events. (Note: this was also when Covid-19 started out and affected us globally)

As observed, for a 5-year cumulative period from October 2015, about two-thirds (66%) of investors made a return higher than the risk-free rate of 2.5% p.a. and 58% since 2014.

No data is available for those that have utilised their SA, and there is also no breakdown for those that have chosen to specifically invest into stocks or gold.

I generally do not recommend my clients to invest into individual stocks if they have minimal experience as it requires time and effort to analyse a company’s financial statements, and monitor their performance. Despite that, companies may still end up liquidating or not performing.

UTs, however, allow you to invest into a basket of companies while being managed by a fund manager. This means that your risk is diversified and returns may only be impacted by larger events such as an economic recession, or government/sector policies depending on the fund that you select.

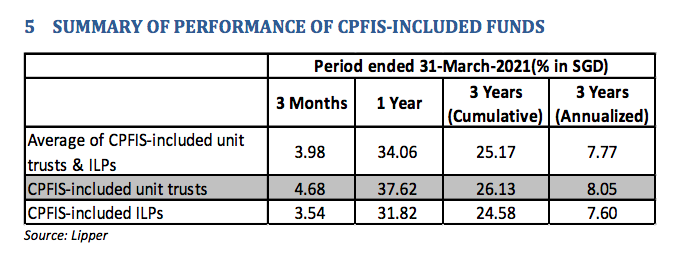

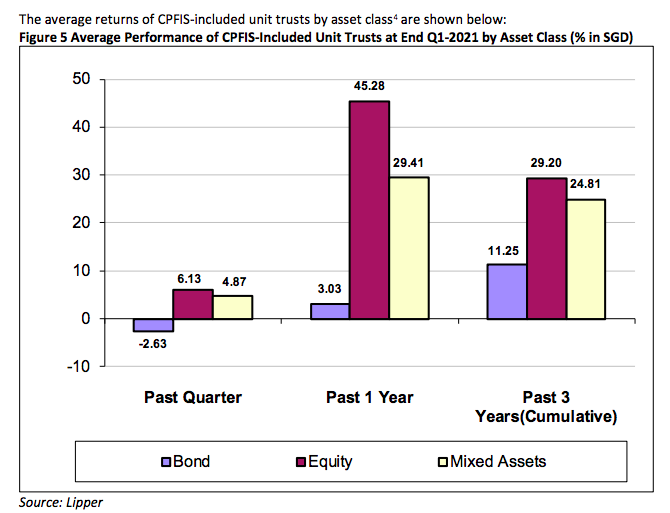

The Lipper report with period ending March 31, 2021 shows the average performances of these funds of up to 3 years, with a breakdown of asset classes shown.

A observed for the past 3-years, the annualised average performance outweighed the both CPF-OA and CPF-SA returns of 2.5% and 4% respectively.

When we breakdown the performance by asset class, with mixed assets generally being a 50% bond and 50% equity split. You will notice that the risk-to-reward of investing into bonds may not be as attractive as equities.

For the past 1 year, if you had invested into a bond fund, your returns would have been 3.03% which is about 0.5% more than that of CPF-OA, with full risk taken on by yourself. In this case,

When comparing the cumulative data for the past 3 years, bond fund average performance was 11.25%, which is 3.62% when annualised, while the equity fund average performance would have given you a 8.91% annualised return.

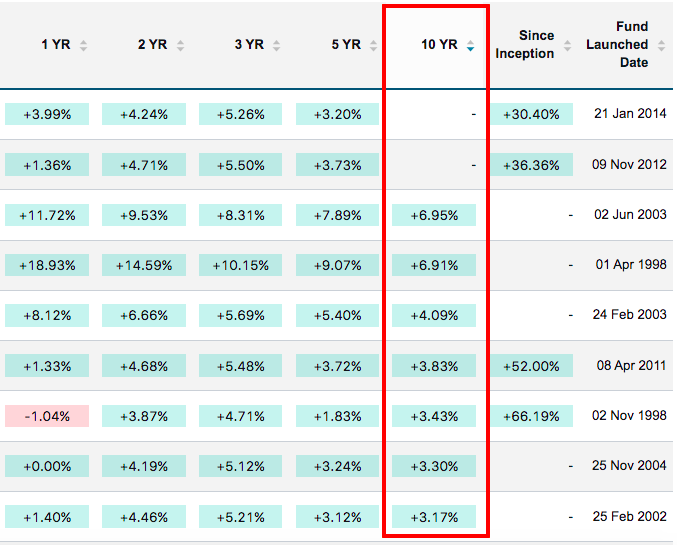

Taking it one step further, I analysed the information provided on iFast, a platform which I use to manage my clients’ investments to see if it made sense to invest one’s CPF.

There are currently 75 funds available under CPFIS-OA, of which 58 are classified equity or alternative investment funds, 3 are mixed-assets and the remaining 14 falling under the categories of either money market, bond or short duration funds, of which are all considered low risk. (As of Aug 2021)

Out of the 75 options available, 9 under-performed over a 5-year period (with 3 negative returns) and 4 under-performed over a 10 year period (with 2 negative returns) against the benchmark of 2.5% p.a.

CPFIS-OA UT Returns in Ascending Order (5 Years)

CPFIS-OA UT Returns in Ascending Order (10 Years)

Under the CPFIS-SA, there are 17 funds available, of which none are classified as equity or alternative investments, 3 balanced, with the remaining 14 falling under the low-risk categories. (As of Aug 2021).

Over a 5-year period, only 3 funds outperformed 4% p.a. (all of which are mixed assets) and only 3 funds out-performed over a 10-year period (with the 3rd at 4.09%).

CPFIS-SA UT Returns in Descending Order (5 Years)

CPFIS-SA UT Returns in Descending Order (10 Years)

As observed, there is a higher likelihood of achieving a higher return when you invest CPF OA funds, with a much lower chance when it comes to investing your SA account.

In addition, as of October 2020, no upfront-charges or sales charges are allowed to be imposed on CPFIS, while annual fees are capped at 0.4% p.a. This means that you would be able to retain majority of your returns.

Despite that, you want to find out if there are any other charges such as a bid-offer or a fund switch fee which may affect your returns.

After running through the numbers, it makes more sense for one to leave their CPF-SA account untouched, and depend on the guaranteed 4% interest rate as the funds available are low-risk. You do not want to take unnecessary risk for minimal upside potential.

On the other hand, it is clear that the probability of achieving better returns through one’s CPFIS-OA and it is an option that could possibly be explored.

Other Considerations

However, there are a few key pointers to take note before you make that decision.

- Time Horizon: How many years do you have before you require access to these funds? Would this be just before 55 when you Retirement Account is formed? Or somewhere between 65 to 70 when you foresee yourself making regular withdrawals from your CPF monies?

- Risk Tolerance: Many of the OA funds available tend to be of higher risk. Are you able to ride through the volatility, as price changes of such assets tend to be wider?

- Investment Strategy: Do you have a plan on how to allocate your funds? Which funds should you choose? Is it simply choosing the ones that have performed the best over time, or should you understand how the markets might perform? (Remember that past performance does not indicate future performance)

- Overall Perspective: Do you have a macro view of all your assets, and not just your CPF balances? This is only one of the tools that you can utilise when planning for your retirement. Others may include life insurance that you purchased previously. How would your investment strategy look like once you bring everything together?

- Other Goals: As you are able to access your CPF to fund for obligations such as your mortgage and your children’s tertiary education, do you foresee yourself having to liquidate these investments or have you set aside separate funds?

- Legacy Planning / Creditors: Investments made under the CPFIS does not fall under the CPF nomination act, which means that you would need a separate Will on how you wish for your funds to be distributed. In addition, creditors now have access to these monies in the event of a bankruptcy.

If the above-mentioned points seem overwhelming, you can contact me to figure out if you should invest using CPF, and how you can use it as part of an overall strategy to fund for your retirement.