Life Insurance: Understanding Needs and Solutions

With so many options in the market, it can become a tedious process when planning for your life insurance needs. Especially if you have never done so before.

Before making any decisions, one should understand that the key purpose of life insurance is income protection. To protect you and your loved ones from having to reduce your quality of life in an unforeseen circumstance and you are unable to work.

The average person requires the most amount of insurance when they are in the accumulation phase of their life-stage. In which, they would have just entered the workforce, purchased a home and has plans to settle down or has started a family of their own.

It is essential to plan for your shortfalls at this point as your earning power is at it’s minimum, while your liabilities and responsibilities would be highest.

Being in the sandwich generation, you would have to set aside provisions for (1) taking care of your parents, especially given increasingly longer life expectancies and the likelihood that we are their “retirement plan”, (2) a mortgage loan we have to service, and (3) having to plan for our children’s well-being and future education and our own retirement.

So how then do you decide…

- How much do you need?

- Which solution would be most beneficial to your personal situation?

- And any other considerations you need to consider so that the interests of your loved ones are protected?

- How often should you have a review?

How much life insurance do you need?

There are generally 3 ways to calculate your shortfall.

- According to the LIA protection gap study done in 2019, the average economically active adult Singaporean requires 9.0x their annual income, before accounting for any other savings or insurances they may have.

- An alternative is to calculate one’s Economic Lifetime Value (ELV). This is done so by the calculating (Annual Income) * (Years to Intended Retirement). Most insurance companies allow one to have cover of up to 30x their annual income, although I have found this to be overly-conservative and costly.

- Lastly, the most personalised (and adequate) solution, is to calculate your Dependents’ Needs – how much is needed to support them, coupled with one’s liabilities such as mortgage loans. Another consideration is also how much their children’s education would cost potentially and if you wish to factor that in.

Which solution would be most beneficial to your personal situation?

Once you have figured out what your shortfalls are, it would aid you in deciding which solution might fit you best.

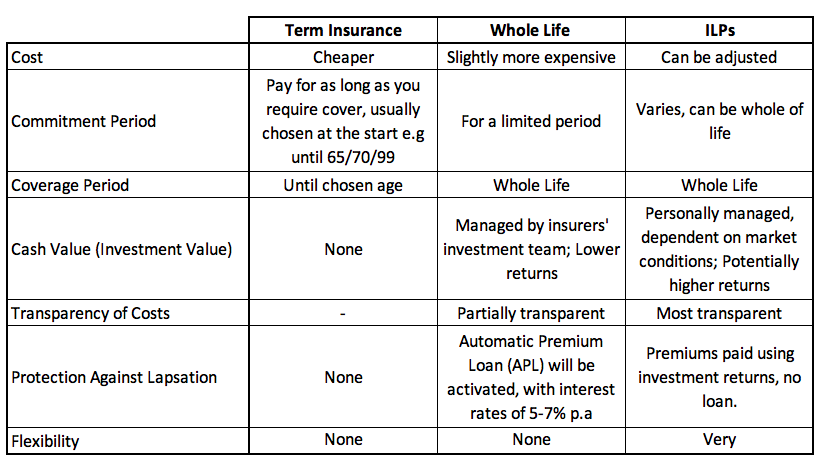

In the market, there are 3 broad solutions that are able to meet one’s shortfalls. They are (1) Term Insurance, (2) Whole Life Insurance, and (3) Investment-Linked Policies, more commonly known as ILPs.

Comparison of the Different Types of Life Insurance

As observed from the table, ILPs are considered the most flexible where one is able to withdraw and deposit funds into. They are usually recommended as a “dual-purpose solution” serving both insurance and investment needs.

On the other hand, there are those prefer not to mix their insurance needs with their investment needs – and they may prefer to purchase a term policy while managing their own investments.

A typical pitch I have heard many financial representatives use is this. “Would you prefer to own your home or rent?” I believe that it is about finding the shortest route between two points, ie figuring out the most productive solution to making your money work hardest for you.

I address it here at “Whole Life Insurance vs Term Insurance: Which Is Better“, on whether it makes sense to mix your needs or not.

While cash values are traditionally pitched as a “retirement tool”, it’s main purpose is to serve as an insurance against the policy from terminating pre-maturely. This could happen when a person has insufficient funds in their bank account (GIRO), or has changed their bank account without updating the insurer.

In addition, if one were to have a change of address and these events occur, reminder letters would not be able to reach you.

Each of these solutions have their own pros and cons and what is more important is learning how to use them to your advantage effectively. You can always consider a mix of solutions to meet your needs both, in the short and long-term.

You may want to read the following for your better understanding and considerations of the different solutions.

Now, the next part that you want to plan for is your critical illness insurance needs. Be sure to click on the link to help you understand the different options and what may suit you best.

Other Considerations

Once you have decide on the solution(s) to help address your needs and have implemented them, the process is not done. Here are a few things that you would want to consider next.

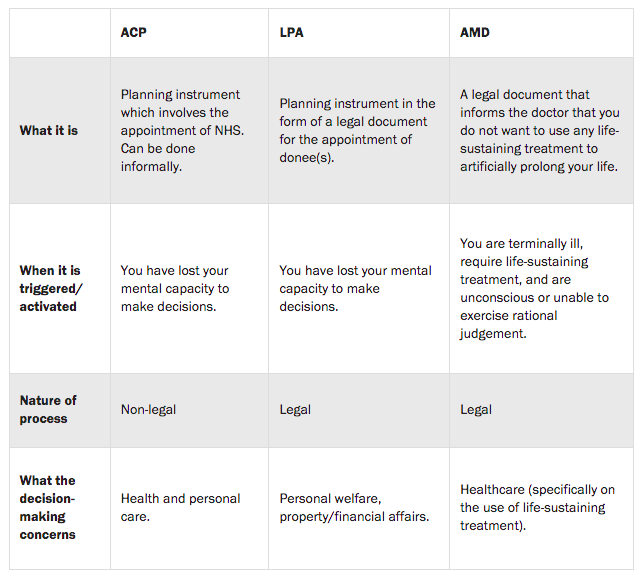

- Doing up your nomination (This is free and is done through the insurer that your policy is with)

- Draft up a Will

- Doing up your CPF Nomination (Money in your CPF accounts do not fall under the purview of the will and a separate is required.)

Source: Singapore Legal Advice

How often should you have a review?

While some financial representatives see the need for a yearly review. I believe that once the above steps are taken effectively, there is no need for an annual meeting. However, regular intervals should be scheduled for your retirement / investment needs to ensure that you are moving towards your goals.

It is during life stage events where a review becomes crucial and these include

- A change in marital status (Marriage/Divorce)

- Having a newborn

- When your child graduates from tertiary education

- Purchase of a new property

- A significant increase in income/expenses

All the above events would trigger a need for a review as these would affect your future expenses. If you need help figuring out your life insurance needs, I welcome you to reach out to me here.